Title

JHENG Renhao

Specialist,

JHENG Renhao

Specialist, Taiwan Creative Content Agency

Overview

Recovery, Financing, and Global Co-Production Trends

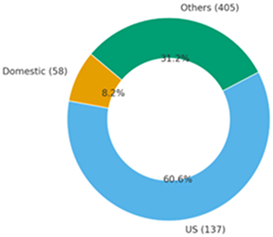

Box Office Market Share by Country

(with Number of Releases)

(with Number of Releases)

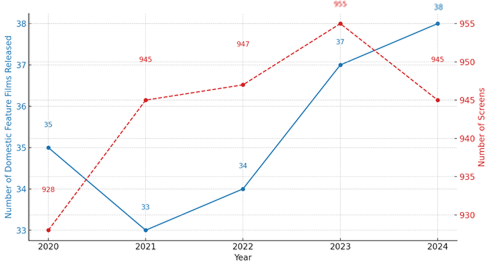

Number of Domestic Feature Films Released and Screens (2020-2024)

Before the COVID-19 pandemic, the total film box office in Taiwan was about NT$10 billion. It has gradually recovered after the pandemic, with the 2023 box office reaching roughly 80% of pre-pandemic levels. In recent years, the growth of streaming platforms has competed with cinemas for audiences, combined with the Hollywood strikes in 2023, resulting in postponed film releases and impacting overall box office performance. The box office market has shown a downturn in the past two years.

In the first half of 2025, due to the slightly lower average box office performance, the overall box office in Taiwan was around NT$2.94 billion, compared to NT$3.04 billion in the same period last year. In recent years, with an uncertain market outlook, film distributors have become more cautious in their investments. This has also led to the new trend of re-releasing classical films in cinemas. For instance, Warner Bros. re-released Interstellar for its tenth anniversary, and as of the first half of this year, it has earned over NT$67 million in box office revenue.

The most awaited Taiwanese film in 2025 is expected to be Left-Handed Girl, the first feature film directed by Taiwanese producer Tsou Shih-ching. It will represent Taiwan in the competition for the Best International Feature Film award at the Oscars in 2026. The film has drawn attention due to Sean Baker’s participation in screenwriting and received favorable reviews after its premiere at the Cannes Film Festival in May. This international co-production between Taiwan, France, the United States, and the United Kingdom also highlights the cross-border co-production strength of the Taiwanese film industry.

Top 10 Overall Box Office (H1 2025)

You can scroll left and right to view the content.

| No | Title | Director | Country | Genre | Gross (Local Currency) |

Gross (USD) |

Production Company | Distribution Company |

|---|---|---|---|---|---|---|---|---|

| 1 | Mission: Impossible – The Final Reckoning | Christopher McQuarrie | US | Action | 435 million | 14.47 million | Paramount Pictures | Paramount Films of China, Inc. Taiwan Branch (U.S.A.) |

| 2 | Attack on Titan the Movie: The Last Attack | HAYASHIYuichiro | Japan | Animation | 144 million | 4.79 million | Mappa | Muse Communication |

| 3 | A Minecraft Movie | Jared HESS | US | Action | 137 million | 4.56 million | Warner Bros. | Warner Bros.(F.E.) Inc. Taiwan Branch (U. S. A.) |

| 4 | Thunderbolts* | Jake SCHREIER | US | Action | 104 million | 3.46 million | Marvel Studios | The Walt Disney Company (Taiwan) |

| 5 | Lilo & Stitch | Dean FLEISCHER CAMP | US | Action | 103 million | 3.43 million | Walt Disney Pictures | The Walt Disney Company (Taiwan) |

| 6 | Captain America: Brave New World | Julius ONAH | US | Action | 102 million | 3.39 million | Marvel Studios | The Walt Disney Company (Taiwan) |

| 7 | How to Train Your Dragon | Dean DEBLOIS | US | Action | 99.48 million | 3.31 million | Universal Pictures | Universal Picture Corporation of China Taiwan Branch (U.S.A.) |

| 8 | Final Destination: Bloodlines | Zach LIPOVSKY,Adam B. STEIN | US | Horror | 87.48 million | 2.91 million | New Line Cinema | Warner Bros.(F.E.) Inc. Taiwan Branch (U. S. A.) |

| 9 | F1: The Movie | Joseph KOSINSKI | US | Action | 87.34 million | 2.91 million | Apple Original Films | Warner Bros.(F.E.) Inc. Taiwan Branch (U. S. A.) |

| 10 | Detective Conan: One-eyed Flashback | SHIGEHARAKatsuya | Japan | Animation | 83.27 million | 2.77 million | TMS Entertainment | Proware Multimedia International |

| Ticket Price Range | We only calculated the average ticket price for theatrical released films, including foreign and local films. The average ticket price on H12025 is NT$ 286.18 (USD 9.52). | |||||||

***Note:"F1: The Movie" was officially released on June 24, 2025. The box office reached 476.78 million until August 29. It's the best performance at box office to date in this year.

Top 10 Domestic Box Office (H1 2025)

You can scroll left and right to view the content.

| No | English Title | Director | Country | Genre | Gross (Local Currency) |

Gross (USD) |

Production Company | Distribution Company |

|---|---|---|---|---|---|---|---|---|

| 1 | Lovesick | HSUFu-Hsiang | Taiwan | Romance | 62.33 million | 2.07 million | Sequoia Entertainment, Lovesick Co. | Sony Pictures Releasing Taiwan Corporation Taiwan Branch(U.S.A.) |

| 2 | Haunted Mountains: The Yellow Taboo | TSAI Chia-Ying | Taiwan | Thriller/Suspense | 28.82 million | 0.96 million | The Tag-Along Co. | Vie Vision Pictures |

| 3 | Invisible Nation | Vanessa HOPE | Taiwan | Documentary | 27.32 million | 0.91 million | 100 Chapters Entertainment, Double Hope Films | Swallow Wings Enterprise |

| 4 | Taiwan Unsung Hero | CHUCharlie | Taiwan | Documentary | 19.88 million | 0.66 million | Studio Gene Young 3D Image | Activator Co. |

| 5 | Organ Child | CHIEHHsueh-Bin | Taiwan | Action | 19.32 million | 0.64 million | Sky Films Entertainment | Sky Films Entertainment |

| 6 | A Chip Odyssey | HSIAO Chu-Chen | Taiwan | Documentary | 13.10 million | 0.44 million | CNEX Studio Corporation, Shang Shan Yi Cultural Studio | Activator Co. |

| 7 | Summer Blue Hour | CHIOUHau-Jou | Taiwan | Romance | 11.81 million | 0.39 million | Arrow Cinematic Group | Vie Vision Pictures |

| 8 | The Uniform | CHUANGChing-Shen | Taiwan | Romance | 10.76 million | 0.36 million | Renaissance Films | Sky Films Entertainment |

| 9 | Where the River Flows | LAI Chun-Yu | Taiwan | Crime | 10.12 million | 0.34 million | Bole Film, Liugong Canal Cultural & Creative Co. | Vie Vision Pictures, Bole Film |

| 10 | Thunderbolt Fantasy: Sword Seekers Final Chapter | HUANGChris, CHENG Pao-Pin, WANG Quan-Xiu | Taiwan | Action | 7.30 million | 0.24 million | Pili International Multimedia | ifilm Co. |

| Ticket Price Range | We only calculated the average ticket price for theatrical released films, including foreign and local films. The average ticket price on H12025 is NT$ 286.18 (USD 9.52). | |||||||

Production Landscape

The average number of domestic films released in Taiwan each year is about 50, mainly feature films. Taking 2024 as an example, a total of 57 domestic films were released, including 38 feature films, followed by 15 documentaries. Regarding animation, due to the industry’s emphasis on animation outsourcing services, original animation production is limited, with only 2 local animated films released in 2024. In recent years, Taiwanese film genres have diversified, with “romance/love,” “suspense/thriller,” and family-themed films being the most prevalent.

Taiwanese film production and distribution companies are mainly small and medium-sized enterprises, with 87.93% and 82.23% of companies having capital under NT$50 million, respectively. Within this context, many films are produced through the director’s or producer’s own company, or a single-purpose production entity is established for individual film projects. Separately, in recent years, production companies with more substantial film output and notable box office performance include Bole Film, co-invested in by the Taiwan Creative Content Agency (TAICCA), as well as Sky Films and Machi Xcelsior Studios.

Calendar Studios, founded in 2020, is a rising Taiwanese film production company that has so far launched two films with box office revenues exceeding NT$300 million: Man in Love and Marry My Dead Body. Marry My Dead Body was soon adapted by the Thai production company GDH 559 into The Red Envelope, which premiered earlier this year and became a box office success.

Leading Taiwanese film studios include Central Motion Picture Corporation and Aaron Film Studio. Well-known post-production companies are Taipei Postproduction; Examples of VFX companies include The White Rabbit Entertainment, Moonshine Studio, Wwwind Studio, and Reno Studios. In the past, local studios, post-production, and VFX companies engaged in domestic film production through in-kind investments, meaning investing time and labor into a production rather than real financial transactions. However, with the polarization of box office performance and the cautious investment climate for local films, this practice has declined.

Lovesick© Sequoia Entertainment, Lovesick Co.

Lovesick© Sequoia Entertainment, Lovesick Co.

Financing Models

Since most film production companies are small-scale, their financing sources depend on government subsidies and co-investments. The production scale of feature films and animations is generally medium-level, ranging from NT$30 million to NT$50 million, with 45.83% of films in 2024 falling within this category.

Taiwanese film production primarily relies on domestic capital investment. Production companies such as CMC Entertainment, MM2 Entertainment, Lots Home, Third Man Entertainment, along with distributors like Sky Films and Machi Xcelsior Studios, are the major investors. Recently, other sectors such as telecom operators Taiwan Mobile and Chunghwa Telecom have also begun investing in films. But in general, external investment from outside the film and television industry remains relatively small. Pre-selling of distribution rights remains uncommon in Taiwanese film production. This is primarily influenced by industry convention, as well as the relatively limited average box office revenues of domestic films.

About 30% of domestic films each year receive subsidies from the Ministry of Culture, which serves as one of the primary sources of funding for Taiwanese films. City governments, such as Taipei, Taichung, and Kaohsiung, also run their own film subsidy programs. Meanwhile, TAICCA supports domestic film production by managing cultural content investments from the National Development Fund. In addition to direct project investments, TAICCA also co-invests with businesses to set up companies for film financing and production. TAICCA’s co-invested companies, MyStory Entertainment and Bole Film, have already established themselves as key film investors and producers in Taiwan.

Regarding tax incentives, the Ministry of Culture revised the Law for the Development of the Cultural and Creative Industries in 2023 to include investments in film development, production, and distribution under tax deductions. Enterprises can deduct 20% of their investment from corporate income tax within 5 years, capped at 50% of the tax owed in a given year. Individuals investing more than NT$500,000 can deduct 50% of their personal income tax liability, up to NT$3 million.

Distribution Climate

Top 5 Distributor’s Market Share (2024)

| Rank | Distributor | Number of Films Released | Box Office Market Share (%) |

|---|---|---|---|

| 1 | The Walt Disney Company (Taiwan) | 10 | 16.16% |

| 2 | Warner Bros.(F.E.) Inc. Taiwan Branch (U. S. A.) | 24 | 14.94% |

| 3 | GaragePlay Inc. | 146 | 11.41% |

| 4 | Universal Picture Corporation of China Taiwan Branch (U.S.A.) | 19 | 7.36% |

| 5 | Medialink Group Limited. | 12 | 6.42% |

| OTHERS | 618 | 43.71% | |

| Total | 829 | 100.0% | |

The Taiwanese film market is still dominated by Hollywood productions. In 2024, American films contributed approximately NT$3.38 billion in box office revenues, representing 54.58% of the overall market. In this context, the Taiwanese box office is led by Hollywood distributors, including Disney, Warner Bros., Universal, Sony, and Paramount.

Among local distributors, GaragePlay, which mainly handles Japanese and Korean films, held the largest box office share among domestic players, taking up 11.41% of the overall market in 2024, ranking third across all distributors. GaragePlay adopts a wide-release strategy, with its distributed titles accounting for about 17% of the overall distributed films.

In the post-pandemic era, Hollywood distributors adopt a more cautious stance, mainly focusing on releasing their own films. Domestic titles are primarily handled by local distributors such as Activator, Sky Films, and Vie Vision. Each has distributed over ten Taiwanese films in the past three years, with Activator surpassing twenty.

Among these, there are examples of vertical integration between distributors and cinemas. Vie Show Cinemas, the largest chain by market share in Taiwan, operates its own distributor, Vie Vision Pictures. Moreover, TAICCA, together with four cinema chains—Vie Show, Ambassador, Showtime, and Shin Kong—founded Bole Film to invest in local films. The aim is to leverage their combined 80%+ cinema market share to expand domestic box office performance.

Theatrical Reach

Top 3 Cinema Chains (2024)

| Rank | Name | Number of Screens | Market Share (%) |

|---|---|---|---|

| 1 | Vie Show Cinemas | 214 | 22.65% |

| 2 | Showtimes Cinemas | 174 | 18.41% |

| 3 | Ambassador Theatres | 99 | 10.48% |

| Others | 458 | 48.47% | |

Indeed, Taiwan’s film policy does not set restrictions on the distribution and screening of foreign films, except for the limitation of 10 Chinese films released and screened annually.

Taiwanese cinemas entirely removed COVID-19 restrictions in 2022, and box office revenues reached a post-pandemic high in 2023. However, in the past two years, the Taiwanese film market has faced fluctuations during recovery. With a reduced number of American films, Japanese animated titles have steadily achieved strong box office results in Taiwan in recent years.

In the past, films surpassing NT$100 million in box office revenues were usually limited to Hollywood productions and a few local titles. In 2023, The First Slam Dunk became the highest-grossing film of the year with NT$456 million. In 2024, Haikyu!! The Dumpster Battle ranked third with NT$268 million, rivaling Hollywood blockbusters. Additionally, Korean films have also achieved solid performance in Taiwan. Exhuma, released in March 2024, also grossed over NT$100 million locally.

On average, the market share of domestic films in Taiwan remains around 15%. In the first half of 2025, local films earned a total of NT$241 million at the box office, which is higher than the NT$217 million recorded during the same period in 2024. Indeed, in the past two years, due to the lack of blockbuster releases in the first half, the market share of local films has been lower—8.21% in 2025, compared to 7.13% in 2024.

Overall, The box office revenue of local productions is highly concentrated in just a few titles. In 2024, the top three domestic films generated over half of the total domestic box office. The gangster series film Gatao: Like Father Like Son, which grossed NT$225 million, was the only local film to break the NT$100 million barrier in 2024, accounting for one-third of the total annual box office generated by all local films.

At the cinema level, with the slowdown in chain expansion and closures of venues, the total number of screens in Taiwan in 2024 was 945, a slight drop of 10 screens from 2023. The market is dominated by chain cinemas; in 2024, 80.63% of all cinema halls were run by chains. Cinemas are concentrated in urban areas, with nearly 40% of screens located in Taipei and surrounding high-population regions. With fewer films released overall, there is surplus screen capacity, and the average run length for both foreign and domestic films has increased in recent years.

Technology and Production Services

The total revenue of Taiwan’s film post-production and VFX sector is about NT$600 million, with films serving as the primary revenue source, followed by television content. In the past, VFX companies usually started working after shooting concluded. In recent years, as more genres require visual effects, VFX planning increasingly begins during pre-production to ensure consistency with the film’s style and needs.

Virtual production is an emerging trend, but due to the modest budgets of most Taiwanese films, the industry remains cautious about adopting the latest technology. Local VFX company MoonShine Studio established its own LED studio in 2021. The following year, Reno Studios built an LED studio at the Central Motion Picture Corporation site, collaborating with traditional studios to provide integrated “virtual production” services. This year, MoonShine announced that a larger LED studio, developed in partnership with Aaron Film Studio, will also launch, aiming at high-spec film and television projects.

96 Minutes which is being released in this September, marks a first for Taiwan’s film industry in its use of Previs technology. Leveraging motion capture integrated with a virtual studio, the production was able to pre-visualize sequences, improving efficiency in both scheduling and cost management. Also, as a rare disaster film in Taiwan, 96 Minutes positions itself as a benchmark in the evolution of post-production visual effects within the local market.

Meanwhile, many enterprises in Taiwan’s film industry have adopted AI technology, mainly in pre-production for script analysis and planning. AI tools are also being applied in post-production and VFX to shorten production cycles and reduce costs.

96 Minutes © WOWING Entertainment Group

96 Minutes © WOWING Entertainment Group

Streaming Platforms and Digital Growth

Top 5 Streamers (2024)

| Rank | Name | Usage rate | Subscription Fee Range (USD) |

Subscription Fee Range (TWD) |

|---|---|---|---|---|

| 1 | Netflix | 65.2% | 9.65-15.30 | 290-460 |

| 2 | YouTube (Premium) | 62.5% | 6.62-15.93 | 199-479 |

| 3 | IQIYI | 27.6% | 7.98-10.65 | 240-320 |

| 4 | Disney+ | 25.7% | 9.48-11.14 | 285-335 |

| 5 | LINE TV | 22.4% | 6.99 | 210 |

*Note: 1. We only have data on the usage rate of OTT platforms in Taiwan, according to a consumer trends survey conducted by TAICCA.

2. The subscription fees presented on the table are the monthly subscription fees of each platform, based on available information.

2. The subscription fees presented on the table are the monthly subscription fees of each platform, based on available information.

Currently, the Taiwanese government has not implemented regulatory policies for streaming platforms. In recent years, proposals to regulate streaming have been raised but are now on hold. Alongside government subsidies and box office earnings, streaming licensing fees are a major income source for Taiwanese films. For some domestic titles with modest theatrical performance, streaming licensing fees can even surpass cinema revenues.

According to TAICCA’s survey, Netflix is the most widely used streaming platform in Taiwan, with about 65.2% of people using it in 2024, followed by YouTube and iQiyi. Disney+ ranked fourth, while local OTT platforms had relatively low user bases. Reviewing Netflix Taiwan’s weekly Top 10 movies in the first half of 2025, most are Netflix originals, such as Bullet Train Explosion or the recent K-Pop Demon Hunters. Netflix also acquired exclusive rights for Gatao: Like Father Like Son, and its release in May spurred renewed viewing of earlier films in the series. However, to date, the platform has not yet invested in any Taiwanese film productions.

Netflix acquires streaming rights for an average of 4–8 Taiwanese films annually, offering higher licensing fees. In recent years, several Taiwanese films have gained international attention after appearing on Netflix. For example, the horror film Incantation ranked third globally among Netflix’s non-English films in 2022 and broke into the Latin American market, previously difficult for Taiwanese films to reach. Local OTT platforms still carry the highest number of Taiwanese films, but most deals follow a revenue-sharing model based on views, resulting in limited earnings.

It is worth mentioning that the relationship between film productions and local OTT platforms goes beyond simple licensing. Telecom operators, such as Taiwan Mobile and Chunghwa Telecom, not only invest in film production but also operate their own OTT platforms, myVideo and Hami Video. Furthermore, the local OTT platform operator CATCHPLAY also invests in original productions and distributes local films.

Left-Handed Girl © Left-Handed Girl Film Production

Left-Handed Girl © Left-Handed Girl Film Production

International Co-Production

A portion of domestic films has traditionally received international investment. In 2024, of the 57 domestic films released, 6 (10.53%) attracted international funding. Including cross-border production collaborations with creative teams, actors, or crew, the number rose to 11, accounting for 19.30%. Taiwanese film companies have also invested in foreign productions, such as horror films from Indonesia and Thailand, and the Korean film Omniscient Reader’s Viewpoint, released this year, also included Taiwanese investors.

Recently, TAICCA has actively forged ties with international production companies, including Korea’s CJ ENM, MBC PLUS, and Something Special, Japan’s Asmik Ace, Singapore’s Mediacorp, and France’s Cinéfrance Studios, creating more opportunities for Taiwanese creators.

In addition, TAICCA supports international co-productions and co-financed projects featuring strong Taiwanese elements through investments from the National Development Fund. In the phase of content development, TAICCA has launched programs aimed at international co-development, such as, “Taiwan Stories on the World Stage”, which supports feature film projects in developing complete scripts with Taiwanese elements in collaboration with international creators, offering up to NT$6 million for each project. Recently, the Minister of Culture unveiled a new film subsidy initiative providing as much as NT$100 million for a single film project, with the goal of supporting works that demonstrate strong potential in the international market.

The most representative international co-production film this year is Left-Handed Girl, scheduled for release in France and Taiwan in September and October, respectively, and expected to be the most anticipated Taiwanese film in the latter half of the year.

JHENG Renhao

Specialist, Taiwan Creative Content Agency

This article was written by Ren Hao Jheng, Department of Research and Strategy, TAICCA, with contributions from:

Bill Sung, Executive Vice President, Cai Chang International

Sam Tzu-hsiang Yuan, Secretary General, New Media Entertainment Association

Shawn Chuang, General Manager, My Story Entertainment

Bill Sung, Executive Vice President, Cai Chang International

Sam Tzu-hsiang Yuan, Secretary General, New Media Entertainment Association

Shawn Chuang, General Manager, My Story Entertainment

**Note: The number of releases data only included the film first released in that year.